Reputation management involves monitoring public perception of your brand. To maintain or build a thriving business a strong reputation will help people trust faster or when choosing a new home service provider, positive reviews will set your business apart from one with no reviews.

A five-star digital presence is important to increase transparency and to gain customer respect. People are more informed about the companies they are considering doing business with. Google Reviews, Yelp, and the BBB are just some of review services where customers can share their experiences, good or bad.

Why is Reputation Management Important?

The longer you’re in business, your company image will develop with or without your help based on your online presence. Successful companies take an active role to learn how people feel about their services. Controlling your reputation so when it is viewed by customers or potential new hires there is no surprises.

Having a strategy in place that includes a way to easily prompt someone to provide five stars or great service comments is the first step

Analyzing Consumer’s Needs

Review give insight into your business and lets you know what is working or not working. Customers also don’t hesitate to point out the things they are unhappy with.

Pay attention to what customers are writing can highlight where attention is needed. Tracking complaints allows a way to spot a single issue tied to poor service or if there is something companywide that’s needs attention. This could help spot if more training is needed, pinpoint issues to a specific employee, and even help the bottom line.

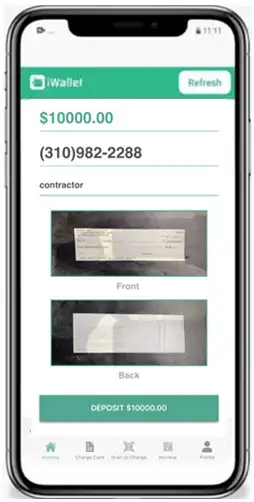

Built-in Tools That Work

Small or large, companies can take advantage of free reputation software when they process with apps such as iWallet. iWallet includes the ability to ask for a review during payment. For no additional charge, there is a dedicated link in the payment flow to one or several review platforms. This provides comprehensive way to get review coverage across all channels.

Additional Benefits

Show you value your customers and their feedback by including their reviews in your website, ads, or social channels. Letting them know you value their opinion by expressing gratitude to their comments, it goes a long way.

A positive workplace helps with recruiting too. When deciding to join a company, potential new employees are likely to trust word-of-mouth information from satisfied customers they read online.

A strong reputation is more likely to attract new and keep loyal customers. Having reputation management as part of the payment flow process opens up the opportunity to get real time reviews.