Payment innovation has evolved and customers are using credit cards for payments more and more because it’s convenient.

But do you know what Interchange Plus, Fixed rate, Cash Discounting and Surcharge Pricing means? If not it this should help you to understand the different pricing models.

Payment Pricing Models

When it comes to credit cards, there are lots of cards your customers will use. Reward cards, platinum cards, student cards, no-fee cards, low-fee cards and travel cards, and each type comes with a different rate for processing. This is a fee that the merchant pays every time someone uses that card.

Every credit card brand (e.g. Visa, MasterCard, Discover) has a published, percentage-based on the interchange fee that they charge every time their cardholders uses their credit card – the cost of authorizing the charge.

Effective Rate

The effective rate is what you are being charged. The best way to know your effective rate is to take a recent statement, look at your fees, than divide that number by how much you processed in credit card sales.

The problem with traditional pricing models is they can hide the interchange cost which allows them to charge a markup. Processors consolidate a variety of rates into a smaller numbers; essentially “round up” to the highest rate in each tier. This makes monthly statements easy to read and makes it hard to see what the real rate the transactions are charged. It also allows the possibility of paying higher rates!

Interchange Plus

Interchange plus, also referred to as “cost plus” pricing, is straightforward pricing. Using cost plus pricing is transparent because it is more difficult to have hidden fees. With this pricing, processors take all the bank fees, card brand fees and pass them to the business owner, then add their markup fee (i.e 20%). You can check out all the interchange rates as they are published by Visa and MasterCard.

With interchange pricing, the business owner pays the non-negotiable interchange fee for the type of credit card and the payment processor markup. The markup is calculated by adding the interchange fee, a basis point mark-up and a per-transaction fee charged by the payment processor.

By showing you the actual interchange costs, interchange-plus pricing allows you to easily see what the markup is. This encourages processors to set reasonable markups plus this transparency helps ensure you are getting the best rates.

Fixed Rate Pricing

The fixed rate model, aka “flat rate” is simple which why it is appealing to appliance repair business owners. If you want to know your real operating costs, paying a flat rate for processing will make the most sense because there are no hidden fees.

Fixed rate is easy to understand and can result in bottom line savings. Business owners can easily calculate credit card processing fees since the rate is the same each month, no matter what type of card or transaction method is used.

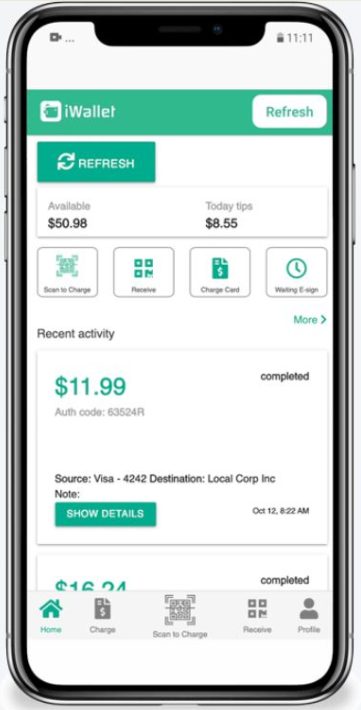

Apps like iWallet Business offer a consistent low flat rate which is why it lots of appliance repair business owners are switching to this. For budgeting you know what to expect—2.3% processing for businesses that process over one million per year and 2.5% for under.

Cash Discounting

A true cash discount program gives the customer a discount for cash payments and avoids additional costs. This model passes the cost of acceptance back to customers who choose to pay with a credit card or debit card.

Giving discounts for cash is legal in all of the 50 states and is well received by the customer. Cash discounting has been around for decades and gaining in popularity. Gas stations have used cash discounts for many years. Paying with cash costs the customer a little less per gallon than paying with a credit card. There are a handful of specific rules to follow to stay compliant, be sure to work with a provider that will help you navigate these rules.

Surcharge Pricing

A surcharge program is a type of credit card processing where you charge the consumer an additional fee “surcharge” on top of the cost of service to cover the merchant processing cost. Surcharge programs are currently legal in almost all 50 states.

A surcharge program recoups merchant service fees that are charged when the customer presents a credit card as payment. A surcharge program doesn’t feel as good to the customer because it adds the additional fee at checkout.

Selecting the best option for your business Paying with a credit card is convenient and fast, but the processing rate differs on each credit card with effects your fees. On top of that monthly fees are determined by the card types, and merchant fees are added on top of the actual cost. It can be hard to decide between the different programs so be sure to consider the many before implementing a new program into your operations. Learning the different terms and how they can help your bottom line and potentially keep more money in your bank account.