The rates that you pay will vary depending on the processor and the pricing model of your individual payment processer.

If you’re considering a new credit card processor, here’s valuable information to help you compare your options so you won’t be misled.

What is Your Savings Potential?

Check your most recent statement to what you are currently paying. If you process over 1m annually and are paying more than 2.5% this may be a good time to push back on your current provided and ask for a fee reduction.

Or it may make more sense to explore other competitive options to learn how you can save on fees. If you have the tools and education, your decision to stay with current processor or move will be easier.

Interchange Plus

Interchange-plus is a pricing model where credit card processors break down the fees that go to the bank or credit card issuer and their markup. There are two components — the interchange fee determined by the card networks and a markup set by the credit card processing company.

The transaction fees that the merchant’s bank account must pay whenever a customer uses a credit/debit card for payment. The fees are paid to the card-issuing bank to pay handling costs, bad debt costs, fraud and the risk involved in the payment approval.

What you need to understand is that there are hundreds of interchange categories – all with different rates. Different categories apply to different transactions, but the processor doesn’t control when they apply. In any given month, multiple interchange rates will appear on your statement; however these rates are the same no matter which processor you use.

Interchange –is the fee that comes directly from the card networks like Visa and Mastercard. Payment processors have no control on these rates, and are required to pay.

Plus – The “plus” is the markup that your credit card processor is charging on top of the interchange fee. This is the percentage fee and a transaction cost.

Generally, interchange-plus pricing is more favorable for small businesses compared other with pricing models such as This is because interchange-plus is not only more transparent, but businesses usually end up paying lower processing costs with this model.

Here’s how interchange-plus stacks up compared with other common pricing models.

Tiered Pricing

Tiered pricing is probably the most common credit card processing model because it simplifies your fees by breaking them down into three main tiers — qualified, mid-qualified and non-qualified.

Qualified Rates –Transactions that fall under this category have lower fees attached to them,

Mid-Qualified – Is the percentage rate charged whenever they accept a credit card that does not qualify for the lowest rate

Non-Qualified –These transactions will charge your higher rates for.

The nature of a transaction will determine the category in which it belongs. Debit cards and non-reward credit card transactions typically fall under the qualified rate, while transactions involving corporate cards, higher rewards cards, and card-not-present transactions would be under the non-qualified category.

Since your transactions are categorized into 3 tiers, the tiered model makes your statement easier to read. The major downside is the tiered pricing model lacks transparency when it comes to your fee breakdown.

Blended Pricing

Blended rates are bundled so that the merchant is paying one overall cost each month which includes a percentage of the transaction total plus a flat fee. This pricing model is used by Square, Stripe and PayPal and the rate might be 2.6% plus 10 cents for in-person transactions. There is no clear way to determine what you are paying becasue fees are charged at an equal and unchanged rate month-to-month.

Flat Rate

Flat Rate pricing means that the credit card processor is charging one flat rate for all credit card transactions, regardless of the fluctuating interchange rate. This model is designed to cover all aspects of your processing in one cost.

Don’t Forget Hidden Fees

Be sure to read the contract because sometimes there are hidden fees that add up.

Cancellation Fee – Many processors use contracts with cancellation fees. They know that once you sign that contract, which are usually three years, you’ll have to pay to get out of it.

Processing equipment – Companies like Square, Cover and require the purchase of card readers or POS equipment.

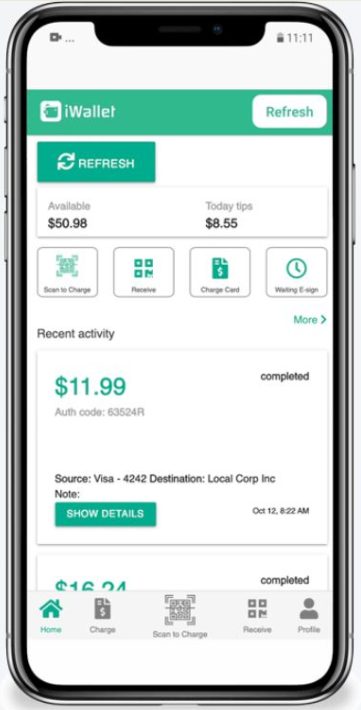

If you want to take more money to the bank by saving on processing fees you should consider iWallet Business App. iWallet has two flat rate processing plans; one for under 1m and 1 for over 1m. No fees to sign up, no equipment to purchase and you can cancel anytime for free. Understanding what is the best payment processing will help you save money. Do your processing research and select the best pricing model for your business needs.