The safest way to make payments for 2024 is contactless transactions. This became popular during COVID and has taken off ever since. Customers want digital advancements and now it is possible for home servicers to accept contactless cards or payment-enabled wearable device over a contactless-enabled smart phone by using a card, phone, watch, or other devices with Near Field Communication (NFC) technology. NFC uses radio-frequency identification (RFID) and electromagnetic induction which helps the devices communicate without Wi-Fi or physical contact.

Tap to pay can also be achieved with Apple or Google Pay by loading an eligible payment card into a payment-enabled phone. The wireless communication technology allows data exchange between two devices typically within a few centimeters of each other.

How Tap to Pay works

First check the credit card to see that it includes the contactless four bar symbol located of front of credit card. The symbol is the indicator that it can be used to tap to pay on a contactless-enabled smart phone equipped with special software. A contactless card or payment-enabled mobile/wearable device must be within 2 inches of a smart phone for the transaction to take place.

NFC antennas in both devices, transmits the data and payment info so the securely stored in the NFC chip and transmitted to the merchant’s terminal. The payment network verifies transaction details and that there is sufficient funds available. Once payment is confirmed a one-time, unique code is generated for that specific transaction. When the card has made contact with phone, the transaction should be complete (approximately one to two seconds).

Is Tap to Pay it safe

Contactless technology requires the home servicer to initiate the payment. Contactless payments, including MC, Visa, bank debt cards, and American Express contactless cards, Google Pay and Apple Pay, all use same NFC (Near Field Communication) technology. A one-time code is generated every time a contactless card or device is used to pay, making it very effective to reducing fraud.

Fraud from skimming is very limited and unlikely. This type of transaction generates a one-time, transaction-specific code. Due to the nature of the unique code and additional fraud protection processes make it difficult to use skimmed cardholder information for fraudulent purchases.

Security Benefits of using Tap to Pay

- Two-factor authentication uses face ID or a PIN which requires additional identity verification.

- Card processing does not include sensitive personal data.

- Each transaction uses tokenization in place of credit or bank information.

- Unique encryption protects personal and credit card information.

Why tapping is the best way to take payment in the field

Tapping with a contactless card or payment-enabled mobile or wearable device helps to avoid touching surfaces. A contactless payment is the quickest way to process credit cards in the field plus more convenient and secure. Virtually impossible to double billed a customer even if they accidentally tap twice.

Merchant Advantages

- Helps alleviate fraudulent disputes as transactions are identified as “Card Present”.

- Safer than magnetic strip or chip cards which are susceptible to fraud.

- Consumer demand is moving to digital wallets.

- Contactless payments keeps employees and customers safe from germs.

- RFID cards transmits a one-time code to reader which identifies each transaction.

- No extra cost to process payments.

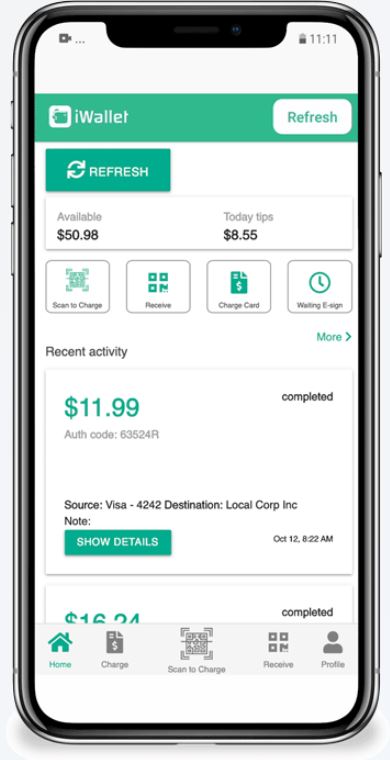

Tap-to-Pay is here to stay

Payments apps like iWallet have contactless payment built in which offers home servicers a way to keep techs and customers germ free. NFC technology offers extra security which is a benefit to customers. Now you can offer seamless, secure transactions to customers in seconds with iWallet.