One of the best developments for small businesses is Remote Deposit Capture technology that is also referred as RDC which makes the process of accepting checks in the field safe and seamless. The mobile check deposit technology actually helps businesses process paper checks faster using a smartphone or tablet.

Remote Deposit Capture API technology is the best choice

Mobile check deposits using an RDC API is a check capture solution that allows employees to use a mobile device to capture check images and convert both the front of the check to federal standards. The API completes a multi-check capture experience allowing developers to deploy this offering into any app.

Remote Check Deposit API technology

APIs have become very common in financial services because they unlock the power of third-party services and tools such as account verification. RDC API technology enables a business to process paper checks deposit faster and safely.

Many businesses still make manually daily/weekly deposits at a local bank which is a waste of resources and time and can be eliminated using an API like iWallet.

No need to pay for desktop equipment

In the past, businesses used RDC technology by integrating a desktop scanner in the office. The scanners are hardware that is purchased and can process both high and low volumes of checks. This may automate a portion of the accounts receivable process by capturing the data on a paper check and sending that information to the bank but it is a dated process.

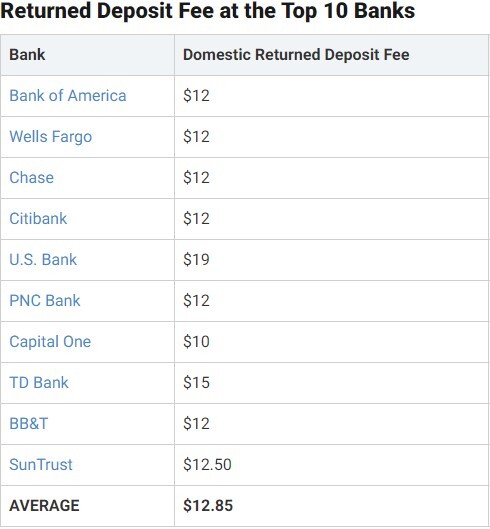

The issue with scanners is that checks need to be dropped off by employees at the end of the day or week which ties up cash flow. It is also a waste of time and gas when you go do it from a phone. Businesses that operate across multiple cities and state often times have employees mail the checks to the home office which runs a risk of getting lost. Other issues small business owners face is the possibility the check is bad.

Helps with risk mitigation

Mobile check deposit API is a seamless approach that shares the check data from a smart phone with a financial institution. It helps a company’s risk mitigation which can lead to fewer bad checks or insufficient funds. Real-time risk mitigation and mobile RDC can ensure you are able to accept that check as soon as it’s presented so they have access to those funds more quickly

Choosing the best Remote Deposit Capture API

iWallet Mobile Check Capture is one of the best APIs to mitigate risk, increase back office efficiencies, and accelerate cash flow.

The API provides the same information; check payee name, address, amount and good image quality for depositing purpose. The check image component, with the corresponding data, is both captured with the API. It is than transmitted to the payment gateway and directed to the client’s financial institution for deposit. The deposit converts the extracted check data (account number, routing number and check number to ACH and submits the actual front of check image to the financial institution.

Also important when selecting an RDC API, make sure it is supported by iOS, Android and mobile web and is offered at both App Store and Google Play Store.

iWallet API offers upload success on the first try using a patented front side of check video capture technology and helps businesses to detect check duplication and manage risk by running all checks through a 3rd party data base.

What is a financial check risk?

When a customer pays with a check you better hope they aren’t a bad check writer and the funds are available. Deposits take a couple of days to settle and that may be too late if they are a bad check writer. iWallet Remote Check Capture API has built in fraud protection and automatically scans a database of bad check writers. It will send a real time notification in if the check is bad. Getting a notification while your employees are still with the customer offers the ability to accept another form of payment.

People still use paper check because there are a number of advantages, so be prepared as they will be around for a while. Remote check deposit capture is a key driver of mobile processing adoption and will help you to streamline processes while speeding up funds.